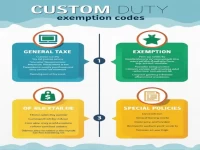

Customs Duty Exemption Nature Codes: A Detailed Explanation and Application Guide

This article provides a detailed overview of the classification structure, specific definitions, and applicable scope of customs exemption nature codes. It primarily includes general taxed import and export goods, materials for gratuitous assistance, and other related tax exemption projects. Through clear code interpretation and analysis of application scenarios, it aids enterprises in accurately understanding and responding to customs policies, optimizing import and export processes, reducing tax risks, and enhancing market competitiveness.